Author:哈特中心 Date:2024-11-27

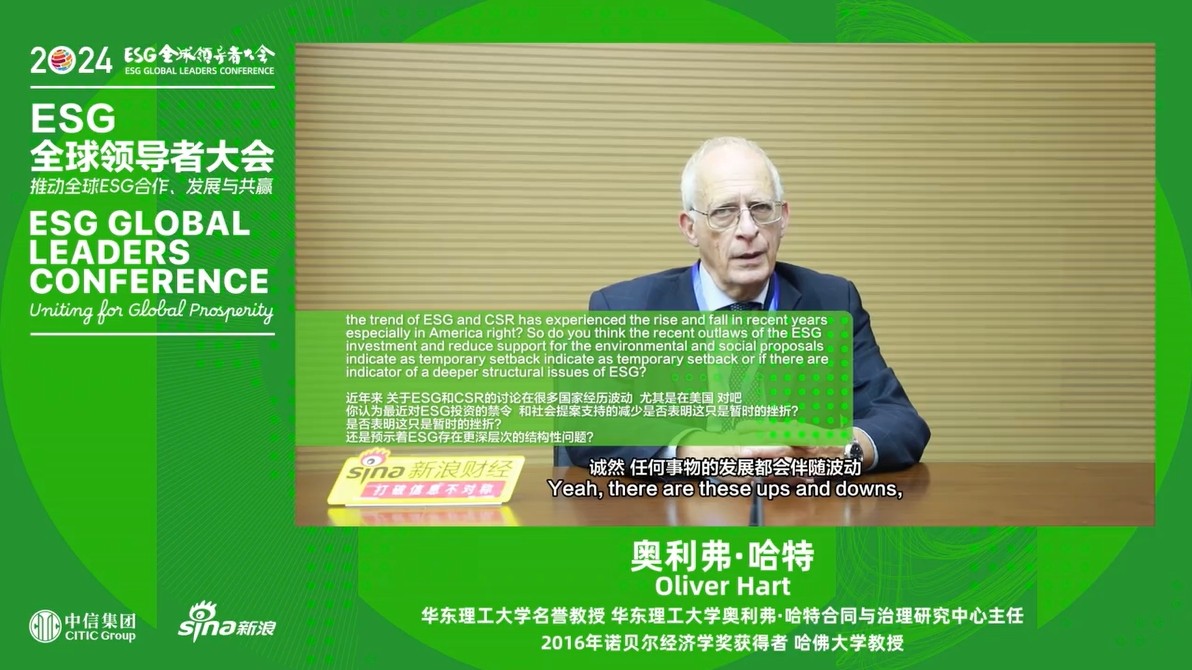

The "2024 ESG Global Leaders Conference" was held in Shanghai from October 16th to 18th. Oliver Hart, an honorary professor at East China University of Science and Technology, Director of the Oliver Hart Center for Contract and Governance at East China University of Science and Technology, the 2016 Nobel laureate in economics, and a professor at Harvard University, had a dialogue with Sina Finance.

2024 ESG Global Leaders Forum Hart's Speech.jpg

Oliver Hart's speech video at the 2024 ESG Global Leaders Conference: https://bsupload.ecust.edu.cn//files/20241127/1732695265759007110.mp4

Recently, the enthusiasm for ESG in Western countries has cooled down, but Oliver Hart still holds an optimistic attitude. He said that ESG is supported by a solid theoretical foundation and practical experience. If people only care about money when investing but care about other things in their lives, it would be a strange world, somewhat like having a "split personality". Once investors realize that the companies they invest in may do bad things on their behalf in certain situations, the pressure for companies to perform better will persist and not disappear.

"The view that 'companies should not only pursue the maximization of shareholder value' has a realistic basis, and I believe that this concept will not disappear easily," he emphasized.

However, he is also skeptical about people's enthusiasm for investing in companies with leading ESG performance. In his opinion, for companies that perform poorly in ESG, instead of divesting, we should give them a voice and help them do better.

Oliver Hart also emphasized that it is very important for the government and the business community to pay attention to ESG sustainability. "If we don't do this, the world will fall into chaos. We have already seen such things happen, and we cannot choose to escape or bury our heads in the sand and pretend that all this doesn't exist. Otherwise, we will eventually find ourselves deeply buried in the sand."

The 2024 ESG Global Leaders Conference was jointly hosted by CITIC Group and Sina Group, and organized by Sina Finance and CITIC Publishing (36.600, 0.05, 0.14%) Group. Kweichow Moutai (1519.050, 10.05, 0.67%) was the chief strategic partner, and China Construction Bank (8.060, 0.08, 1.00%) and Great Wall Motor (26.540, 0.44, 1.69%) were the strategic partners.

The following is the transcript of the dialogue:

Sina Finance: Nice to meet you, Mr. Hart. My first question is that in recent years, discussions about ESG and CSR have fluctuated in many countries, especially in the United States. Do you think that the recent marginalization of ESG investment and the decrease in social support indicate that this is just a temporary setback? Or does it herald deeper structural problems in ESG?

Oliver Hart: I personally hold a rather optimistic attitude. Admittedly, the development of anything is accompanied by fluctuations, but I think these issues are supported by a solid theoretical foundation and practical experience. I don't think these concerns will disappear.

Because investors' concerns go far beyond financial returns. They are also human beings. If people only care about money when investing but care about other things in their lives, it would be a strange world, and this situation is somewhat like having a "split personality".

I think once they realize that the companies they invest in may do bad things on their behalf in certain situations - ostensibly acting on their behalf, but actually not really representing them because that's not what they really want. Once investors realize this, the pressure for companies to perform better will persist and not disappear.

I'm writing a book on this topic, and once the book is published, everything will change.

Some ideas are not good. They may get a little attention or a lot of attention, but as people get bored with them, those bad ideas will disappear. In fact, these ideas have no value from the start.

"The view that 'companies should not only pursue the maximization of shareholder value' has a realistic basis, and I think this concept will not disappear easily."

Sina Finance: Doing good deeds and doing business should complement each other, but there are indeed many challenges. How do you think different departments, such as the government and enterprises, should overcome obstacles and seize the opportunities brought by ESG and sustainable development?

Oliver Hart: I think there are many misunderstandings in this regard. Many people talk about green investment choices. Just based on the outflow of ESG funds, they assert that investors have lost interest in green investment. In fact, many ESG funds only focus on screening high-quality companies for investment and lack in-depth interaction with enterprises. I think this strategy is wrong.

The news says that people are no longer willing to invest in ESG funds as they did four years ago. In fact, this argument has no impact on me. Because in my opinion, this is not a good strategy in itself.

Because if I only invest in companies that are already doing well, who will invest in companies that are not doing well? Will people with less social responsibility than me invest in them? Then these companies that are not doing well will have no pressure and will not want to get better, because we have divested from them, and reasonable voices will no longer be present in these companies.

So, I have always emphasized that we should give them a voice and help them do better. This is a more sustainable approach. I think we should encourage them to speak up instead of divesting or not investing in them.

Sina Finance: You have mentioned giving a voice instead of divesting several times, and you have also provided various methods to enhance the voice of stakeholders. Could you please explain these methods to us? Which one do you think is the most useful in practical applications?

Oliver Hart: I'm very happy to answer this question. I just mentioned two ways for shareholders to voice their opinions, but there is a third way.

To sum up, the first way to make the voices of stakeholders heard is to let them participate in voting personally, instead of just relying on mutual funds to vote on their behalf. We should not only focus on financial returns and only care about money without considering other aspects. I think this is not good and should not continue. So the first way is to let individual shareholders vote by themselves.

However, this method has limitations. No one is willing to spend a lot of time studying voting matters. They may be very small shareholders of 500 companies and will not spend all their time deciding whether to vote. The solution to this problem is proxy voting.

One of my favorite companies is ICONICS. It will ask you some questions to determine what you really care about, such as your social preferences. The whole process only takes 20 to 25 minutes. After completing the questionnaire, they will have an algorithm to transform my answers into a voting strategy, so I don't need to vote by myself. We're not sure whether this method will be popular. For example, if investors of large asset management companies like Vanguard Group or BlackRock are provided with questionnaires, will they actively participate or not participate at all and continue to let the asset management companies vote on their behalf? We don't know the result yet.

The second way is to require asset management companies to clearly announce the voting or participation strategies they implement in the fund, and investors can decide whether to support investing money with them. For example, Vanguard Group can set up an index fund that emphasizes promoting companies to make certain trade-offs. It can also set up another fund that focuses on maximizing company profits. I may decide to invest in the first fund, and you may choose to invest in the second fund. This is another way.

The third way is the one I'm particularly interested in. It is to let asset management companies directly understand investors' preferences instead of letting them vote by themselves. In fact, BlackRock has found through the investors of its S&P 500 index fund what kind of trade-offs they are willing to make in investment decisions.

How to do it? One way is to hold so-called investor conferences. The company randomly selects about 100 to 150 investors to participate. Obviously, not every investor has the same investment share. We think that if you invest more, you are more likely to be randomly selected. However, once selected, each investor will only have one vote. In other words, a larger investment amount only means a higher possibility of being selected initially. The deliberations of the conference can be like the citizen assemblies in some countries, providing suggestions for major social decisions through collective deliberation. For example,

How does the investor conference operate? Participants can use the weekend for face-to-face communication. The conference can also provide resources for investors, such as full reimbursement for accommodation and meals, and may also provide additional subsidies.

In addition, the conference can invite experts to elaborate on specific issues from both positive and negative aspects. Investors can listen to the opinions of experts from both sides. Meetings can be held remotely via Zoom, and then face-to-face meetings can be held again. They will give some suggestions, which will directly guide how asset management companies interact with portfolio companies.

In fact, companies themselves can also hold investor conferences to understand investors' ideas.

These three ways are all effective ways to encourage shareholders to voice their opinions. I hope to continue to promote them, and we need to see which one is effective.

Sina Finance: I'm very interested in the mechanism of the conference. How does it work?

Oliver Hart: We are still studying it, but now you know a little more.

Sina Finance: Yes, especially you have shown us a more equal voting system that allows the voices of stakeholders to be expressed. My last question is, looking to the future, what are your expectations for the future prospects of ESG investment and sustainable practices?

Oliver Hart: The situation changes every year, and we can only wait and see. I hope that the ideas I just mentioned can be truly implemented. It would be great if we can persuade asset management companies to try to hold such conferences. We can see its effectiveness. After all, we need to see whether many things are effective in practice and how they work.

The development of the world is always full of uncertainties. Things you think won't happen may happen, and things you expect may not come true. So I can't predict. But as I said, I think these issues will not disappear on their own. We can't go back to the previous model either.

Why is it still so important for companies and the government to pay attention to ESG sustainability?

Because if we don't do this, the world will fall into chaos. We have already seen such things happen, and we cannot choose to escape or bury our heads in the sand and pretend that all this doesn't exist. Otherwise, we will eventually find ourselves deeply buried in the sand.

Oliver Hart's speech at the 2024 ESG Global Leaders Conference.mp4

Original link address: